Tariq Ali on Greece

Tariq Ali

LRB

July 2015

In the early hours of 16 July, the Greek parliament voted overwhelmingly to give up its sovereignty and become a semi-colonial appendage of the EU. A majority of the Syriza Central Committee had already come out against the capitulation. There had been a partial general strike. Tsipras had threatened to resign if fifty of his MPs voted against him. In the event six abstained and 32 voted against him, including Yanis Varoufakis, who had resigned as finance minister after the referendum, because, he said, ‘some Eurogroup participants’ had expressed a desire for his ‘“absence” from its meetings’. Now parliament had effectively declared the result of the referendum null and void. Outside in Syntagma Square thousands of young Syriza activists demonstrated against their government. Then the anarchists arrived with Molotov cocktails and the riot police responded with tear-gas grenades. Everyone else left the square and by midnight it was silent again. It’s difficult not to feel depressed by all this. Greece has been betrayed by a government that when elected only six months ago offered hope. As I walked away from the empty square the EU’s coup brought back memories of another.

I first went to Greece at Easter 1967. The occasion was a peace conference in Athens honouring the left-wing Greek deputy, Grigoris Lambrakis, murdered by fascists in Salonika in 1963 as the police looked on, and later immortalised in Costa-Gavras’s movie Z. Half a million people attended his funeral in Athens. During the conference wild rumours began to spread around the hall. On the podium, a Buddhist monk from Vietnam couldn’t understand why people had stopped listening to him. Someone with family connections in the military had reported that the Greek military, backed by Washington, was about to launch a coup to pre-empt elections in which they feared the left might do a bit too well. The foreign delegates were advised to leave the country straightaway. I caught an early-morning flight back to London. That afternoon tanks occupied the streets. Greece remained under the Colonels for the next seven years.

I went to Athens this month for the same reason: to speak at a conference, this one ironically entitled ‘Rising Democracy’. Waiting for a friend in a café in Exarchia, I heard people discussing when the government would collapse. Tsipras still has supporters convinced that he will triumph whenever the next election is held. I’m not so sure. It has been an inglorious six months. The young people who voted for Syriza in large numbers and who went out and campaigned enthusiastically for a ‘No’ vote in the referendum are trying to come to grips with what’s happened. The café was packed with them, arguing furiously. At the beginning of the month they were celebrating the ‘No’ vote. They were prepared to make more sacrifices, to risk life outside the Eurozone. Syriza turned its back on them. The date 12 July 2015, when Tsipras agreed to the EU’s terms, will become as infamous as 21 April 1967. The tanks have been replaced by banks, as Varoufakis put it after he was made finance minister.

Greece, in fact, has a lot of tanks, because the German and French arms industries, eager to get rid of surplus hardware in a world where wars are fought by bombers and drones, bribed the politicians. During the first decade of this century Greece was among the top five importers of weapons, mainly from the German companies Ferrostaal, Rheinmetall and Daimler-Benz. In 2009, the year after the crash, Greece spent €8 billion – 3.5 per cent of GDP – on defence. The then Greek defence minister, Akis Tsochatzopoulos, who accepted huge bribes from these companies, was convicted of corruption by a Greek court in 2013. Prison for the Greek; small fines for the German bosses. None of this has been mentioned by the financial press in recent weeks. It didn’t quite tally with the need to portray Greece as the sole transgressor. Yet a Greek court has been provided with conclusive evidence that the largest tax avoider in the country is Hochtief, the giant German construction company that runs Athens airport. It has not paid VAT for twenty years, and owes 500 million euros in VAT arrears alone. Nor has it paid the contributions due to social security. Estimates suggest that Hochtief’s total debt to the exchequer could top one billion euros.

It is often in times of crisis that radical politicians discover how useless they are. Paralysed by the discovery that those they thought were friends are not their friends at all, they worry about outrunning their voters and lose their nerve. When their enemies, surprised that they have agreed to more than the pound of flesh demanded, demand more still, the trapped politicians finally turn to their supporters, only to discover that the people are way ahead of them: 61 per cent of Greeks voted to reject the bailout offer.

It’s no longer a secret here that Tsipras and his inner circle were expecting a ‘Yes’ or a very narrow ‘No’. Taken by surprise, they panicked. An emergency cabinet meeting showed them in full retreat. They refused to get rid of the ECB placeman in charge of the Greek State Bank, and rejected the idea of nationalising the banks. Instead of embracing the referendum results, Tsipras capitulated. Varoufakis was sacrificed. The EU ministers loathed him because he spoke to them as an equal and his ego was a match for Schäuble’s.

Why did Tsipras hold a referendum at all? ‘He’s so hard and ideological,’ Merkel complained to her advisers. If only. It was a calculated risk. He thought the ‘Yes’ camp would win, and planned to resign and let EU stooges run the government. The EU leaders launched a propaganda blitz and pressured the Greek banks to restrict access to deposits, warning that a ‘No’ vote meant Grexit. Tsipras’s acceptance of Varoufakis’s resignation was an early signal to the EU that he was about to cave in. Euclid Tsakalotos, his mild-mannered successor, won the rapid approval of Schäuble: here was someone he could do business with. Syriza accepted everything, but when more was demanded, more was given. This had nothing to do with the economy, and everything to do with politics. ‘They crucified Tsipras,’ an EU official told the FT. Greece had sold its sovereignty for a third bailout and an IMF promise to help reduce its debt burden – Syriza had begun to resemble the worm-ridden cadaver of the discredited Pasok.

It, too, was once a party of the left. In 1981, when it first came to power, its leader, Andreas Papandreou, was hugely popular and in his first six months in office he pushed through real reforms – not the regressions that neoliberals call ‘reforms’ today. Many students radicalised by the struggle against the dictatorship, as well as many Marxist intellectuals who had contested US hegemony, flocked to join it. Within a few years some of the best known among them had been integrated morally and politically within the new structures of power as Papandreou took the country into the EU. But as the years passed Pasok degenerated. In this century it has been virtually indistinguishable from its old rival, New Democracy.

Syriza is a child of the current crisis and the movements spawned by it. A political instrument was needed to challenge the existing parties and Syriza was it. The aims that Tsipras has now abandoned were listed in the Thessaloniki programme, republished below, which the party accepted unanimously in September last year.

On their first trip to Berlin on 20 February this year, Schäuble made clear to Tsipras and Varoufakis that their programme was incompatible with membership of the Eurozone. Tsipras agreed to put the programme on hold and was offered a few ‘concessions’: the Troika – the auditors representing the European Commission, the European Central Bank and the IMF – was replaced with a structure that was supposedly more accountable and whose bureaucrats would not be allowed to enter Greek ministries. This was claimed by Tsipras and Varoufakis as a victory. The truth was the opposite. It is now known that Schäuble offered an amicable, organised Grexit and a cheque for 50 billion euros. This was refused on the grounds that it would seem to be a capitulation. This is bizarre logic. It would have preserved Greek sovereignty, and if Syriza had taken charge of the Greek banking system a recovery could have been planned on its terms. The offer was repeated later. ‘How much do you want to leave the Eurozone?’ Schäuble asked Varoufakis just before the referendum. Again Schäuble was snubbed. Of course the Germans made the offer for their own reasons, but a planned Grexit would have been far better for Greece than what has happened.

When capitalism went into crisis in 2008, the scale of the disaster was such that Joseph Stiglitz was convinced it was the end of neoliberalism, that new economic structures would be needed. Wrong, alas, on both counts. The EU rejected any notion of stimulus, except for the banks whose recklessness, backed by politicians, had been responsible for the crisis in the first place. Taxpayers in Europe and the United States gave trillions to the banks. The Greek debt by comparison was trivial. But the EU didn’t want to make any shifts that could damage the process of financialisation that they had insisted was the only way forward. Greece, the weakest link in the EU chain, went first, followed by Spain, Portugal, Ireland. Italy was on the brink. The Troika dictated the policies to be followed in all these countries. Conditions in Greece have been horrific: a quarter of a million Greeks applied for humanitarian relief to buy food and help with rent and electricity; the percentage of children living in poverty leaped from 23 per cent in 2008 to 40.5 per cent in 2014 and is now approaching 50 per cent. In March 2015 youth unemployment stood at 49.7 per cent, 300,000 people had no access to electricity and the Prolepsis Institute of Preventive Medicine found that 54 per cent of Greeks were undernourished. Pensions dropped by 27 per cent between 2011 and 2014. Syriza insisted that this constituted collective punishment, and that a new ‘deal’ was needed, one that aimed to bring some improvement to the conditions of everyday life.

The EU has now succeeded in crushing the political alternative that Syriza represented. The German attitude to Greece, long before the rise of Syriza, was shaped by the discovery that Athens (helped by Goldman Sachs) had cooked its books in order to get into the Eurozone. This is indisputable. But isn’t it dangerous, as well as wrong, to punish the Greek people – and to carry on doing so even after they have rejected the political parties responsible for the lies? According to Timothy Geithner, the former US treasury secretary, the attitude of the European finance ministers at the start of the crisis was: ‘We’re going to teach the Greeks a lesson. They lied to us, they suck and they were profligate and took advantage of the whole thing and we’re going to crush them.’ Geithner says that in reply he told them, ‘You can put your foot on the neck of those guys if that’s what you want to do,’ but insisted that investors mustn’t be punished, which meant that the Germans had to underwrite a large chunk of the Greek debt. As it happens, French and German banks had the most exposure to Greek debt and their governments acted to protect them. Bailing out the rich became EU policy. Debt restructuring is being discussed now, with the IMF’s leaked report, but the Germans are leading the resistance to it. ‘No guarantees without control’: Merkel’s response in 2012 remains in force.

The capitulation means more suffering, but it has also led to questions being asked more widely about the EU, its structures and its policies. For Greeks of virtually all political persuasions the EU was once seen as a family to which one must belong. It has turned out to be a pretty dysfunctional family. I hadn’t been thinking of voting in the EU referendum in Britain whenever it takes place. Now I will. I’ll vote ‘No’.

17 July 2015

The Thessaloniki Programme

We demand immediate parliamentary elections and a strong negotiation mandate with the goal to:

Write off the greater part of public debt’s nominal value so that it becomes sustainable in the context of a ‘European Debt Conference’. It happened for Germany in 1953. It can also happen for the South of Europe and Greece.

Include a ‘growth clause’ in the repayment of the remaining part so that it is growth-financed and not budget-financed.

Include a significant grace period (‘moratorium’) in debt servicing to save funds for growth.

Exclude public investment from the restrictions of the Stability and Growth Pact.

A ‘European New Deal’ of public investment financed by the European Investment Bank.

Quantitative easing by the European Central Bank with direct purchases of sovereign bonds.

Finally, we declare once again that the issue of the Nazi Occupation forced loan from the Bank of Greece is open for us. Our partners know it. It will become the country’s official position from our first days in power.

On the basis of this plan, we will fight and secure a socially viable solution to Greece’s debt problem so that our country is able to pay off the remaining debt from the creation of new wealth and not from primary surpluses, which deprive society of income.

With that plan, we will lead with security the country to recovery and productive reconstruction by:

Immediately increasing public investment by at least €4 billion.

Gradually reversing all the Memorandum injustices.

Gradually restoring salaries and pensions so as to increase consumption and demand.

Providing small and medium-sized enterprises with incentives for employment, and subsidising the energy cost of industry in exchange for an employment and environmental clause.

Investing in knowledge, research and new technology in order to have young scientists, who have been massively emigrating over the last years, back home.

Rebuilding the welfare state, restoring the rule of law and creating a meritocratic state.

We are ready to negotiate and we are working towards building the broadest possible alliances in Europe.

The present Samaras government is once again ready to accept the decisions of the creditors. The only alliance which it cares to build is with the German government.

This is our difference and this is, at the end, the dilemma:

European negotiation by a Syriza government, or acceptance of the creditors’ terms on Greece by the Samaras government.

Poasis II: Selected Poems 2000-2024

Poasis II: Selected Poems 2000-2024 “Todesguge/Deathfugue”

“Todesguge/Deathfugue” “Interglacial Narrows (Poems 1915-2021)”

“Interglacial Narrows (Poems 1915-2021)” “Always the Many, Never the One: Conversations In-between, with Florent Toniello”

“Always the Many, Never the One: Conversations In-between, with Florent Toniello” “Conversations in the Pyrenees”

“Conversations in the Pyrenees” “A Voice Full of Cities: The Collected Essays of Robert Kelly.” Edited by Pierre Joris & Peter Cockelbergh

“A Voice Full of Cities: The Collected Essays of Robert Kelly.” Edited by Pierre Joris & Peter Cockelbergh “An American Suite” (Poems) —Inpatient Press

“An American Suite” (Poems) —Inpatient Press “Arabia (not so) Deserta” : Essays on Maghrebi & Mashreqi Writing & Culture

“Arabia (not so) Deserta” : Essays on Maghrebi & Mashreqi Writing & Culture “Barzakh” (Poems 2000-2012)

“Barzakh” (Poems 2000-2012) “Fox-trails, -tales & -trots”

“Fox-trails, -tales & -trots” “The Agony of I.B.” — A play. Editions PHI & TNL 2016

“The Agony of I.B.” — A play. Editions PHI & TNL 2016 “The Book of U / Le livre des cormorans”

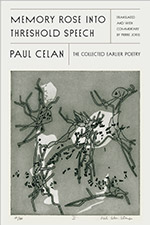

“The Book of U / Le livre des cormorans” “Memory Rose Into Threshold Speech: The Collected Earlier Poetry of Paul Celan”

“Memory Rose Into Threshold Speech: The Collected Earlier Poetry of Paul Celan” “Paul Celan, Microliths They Are, Little Stones”

“Paul Celan, Microliths They Are, Little Stones” “Paul Celan: Breathturn into Timestead-The Collected Later Poetry.” Translated & with commentary by Pierre Joris. Farrar, Straus & Giroux

“Paul Celan: Breathturn into Timestead-The Collected Later Poetry.” Translated & with commentary by Pierre Joris. Farrar, Straus & Giroux

Greece, the Left’s new Palestine, is fashionable for some but let me see if I understand this. They borrow money they cannot afford to repay. They allow tax evasion, create unsupportable social programs and blame someone, anyone else. They promise to fix all that. They don’t. They do not repay what they owe unless given the money to do so. Their debt is reduced, extended and forgiven. They borrow again and again. The process is repeated with the same results and it is never, ever their fault. They were apparently forced, at gunpoint I can only presume, to borrow, to evade all taxes, to fake blindness. They were forced to spend. Name a country that wouldn’t sign up for this?

Krugman and his ilk, Stiglitz and Piketty, choose to overlook that their oft misquoted idol, John Maynard Keynes, advocated both tax cuts and budget surpluses. Other people’s money was never an on-going policy option for Keynes. Yes, Keynes did believe in artificially stimulating demand by increasing government spending but he also believed in cutting taxes. Krugman please note, Keynes believed in cutting taxes as a stimulant! The idea was to cause either the government or the public to increase spending in order to stimulate the economy. These goals were to be achieved through fiscal policy, spending measures or tax cuts.

Fact, Germany and the other creditors have just provisionally agreed to lend Greece another US $100 billion or so, the third such bailout in the past five years! They have opened the door to debt reduction and extended repayment schedules at lower interest rates. Another $40 billion will be provided through various EU programs. There will also be the continuing issuance of tens of billions in liquidity to the Greek banking system through the European Central Bank. What bastards those Germans!

The Greeks and their politicians are delusional. Few trust them to run a lemonade stand. They require oversight. Simply put, living the life it wants, on other people’s money, Greece can’t pay its debts. They are a black hole that has sucked up hundreds of billions; a sunny third world country that has no place in any European Union. Let them go. Bring back the Drachma. At least then the EU won’t have to keep forcing Euros, debt reduction and deferments on them.

Any competent Greek government would have enacted most of the reforms on its own long ago. Any competent electorate would have demanded it. In fact, most of the latest reforms are those Greece said it would make in return for the two previous bailouts. They didn’t. Who believes this time will be any different?

A chain of radical left party victories in the debtor nations could trigger the end of the Euro as we know it. This would be better for the strong economies in the long run. Who can afford more Greece? Bring on the Radicals!

Greece needs an attitude adjustment. Life does not owe them a living. Debt is the main impediment to any recovery. Substantive reforms, much like post war Germany experienced, are the remedy. Misdirected Keynesians, like Krugman and company, who prescribe more debt as the cure for every ill should realize that deficits financed from other governments’ taxpayers are not what Keynes had in mind.

Greece and their fudged books should never have been admitted to the Eurozone but their presence fulfilled the dream now soon to become a nightmare. Once in you somehow can’t leave? This notion persuaded the grasping Greeks wrongly to believe they had the right and the power to write their own ticket. Greece, a nation of only 11 million people, owes 323 billion euros and now needs another 86 billion euros just to get through the next three years. And then what? There are 350,000,000 Europeans. Greek debt now amounts to 1,000 Euros per person or approximately 4,000 Euros per family. Maybe they can all write a nice cheque. The Greeks have tried borrowing their way to solvency. They have tried voting their way there. Could 350,000,000 personal cheques be any nuttier?

Germany has sadly been portrayed as the “heavy” in the Greek drama merely because they believe in following the rules. Bad Germany. Even their socialists have hardened their positions. They recognize the benefits of capitalism and have come to see that fiscal irresponsibility is a threat to Germany and its welfare state. Germany also values what they and France like to call the ‘European Project’. But France is largely impotent. Power lies in the hands of those with the most money and France sits in the next rung of worry just behind Italy, Portugal and Spain.

Tsipras insisted that Greece must run its own affairs, financed by others, of course. Tsipras? Run what exactly? Instead Eurocrats and IMF officials will be sent to keep one eye on all the money Greece receives and both eyes on what it spends. I guess the toffs need tans. Germany got a foreign military presence for over 8 years among other massive reforms. That may be next if Greece is to avoid total economic collapse and stay in the now clearly shaky union. If there are any sensible Greeks left in the country they will get their money out of Greece asap! Drachma anyone?

Greece’s debt has now been increased. They cannot pay it, whatever it is. Even after the lenders write a chunk off, Greece will still not be able to pay. They are a 3rd world country living, as 3rd world countries are wont to do, on other people’s money. It is not sustainable for them or their lenders. The timeline to repayment of debt, any debt, is infinity.

Greece is the worst free-spending government in the EU. Their public sector is over-bloated even by the standards of over-bloated EU public sectors. Their completely unsustainable welfare system is subject to massive abuses. But they are not alone. The EU system allows its members to flout restrictions on deficits and debts for the sake of building the dream, the overly bureaucratic mega-state where banks are bailed out for indulging failed states and economies. Today Greece. Tomorrow it could be Italy, Spain or Portugal. France is next for a major overhaul. The Euro, if not the EU itself, is wobbly as currently constituted.

Instead of Germany, more criticism should be directed at the IMF which shouldn’t even exist today. The IMF was originally created to assist in post-war reconstruction as agreed upon on at the Bretton Woods conference in 1944. The Bretton Woods system ceased to exist in the early 1970s but not the IMF. It chose to reinvent itself as an organisation doing everything from fostering global monetary co-operation to poverty reduction around the world, among many other non-mandated things. As an international “lender of last resort,” the IMF promotes the kind of lending it was designed to clear up. Ultimately, the IMF just makes things worse. In 2003, the IMF adopted an “exceptional access” framework that said that it would only lend if there was “a high probability that debt will remain sustainable.” The IMF broke its own rules by making a 30 billion Euro loan to Greece five years ago after failing to establish the sustainability of Greek debt with any degree of probability.

I read Tariq Ali and the Thessaloniki Programme. My suggestion? Poland. Of all the former socialist countries, Poland is the one most often held up as a success story, both economically and politically. According to the World Bank, Poland hasn’t experienced negative economic growth since 1992. Unlike Greece, Poland has made fundamental structural changes to their economy. Some were drastic, some were costly and all were painful. Those reforms are paying off. The fundamentals of Poland’s economy are healthy. Poland is a well-established Parliamentary democracy with clear rules. They also have modern infrastructure, an educated workforce and are strategically located.

The crisis for several EU Member States is over-indebtedness. Poland will soon fulfill all the necessary membership criteria including inflation, deficit, public debt and interest rates. Healthy economies profit from being in the Eurozone. Unhealthy economies risk problems like those in Greece. Poland has overcome the institutional and structural problems that are present in so much of the Eurozone today.

The Euro should bring benefits. It lowers transaction costs for companies and citizens, allows for easier capital flows, investment, trade and services. But the Poles are no fools. There is public scepticism towards joining the Euro. Polls of Poles suggest the majority want to keep the Złoty. They will join, of course, but only with an exchange rate that can secure the competitiveness of Polish export-oriented businesses. Poland’s growth has and will be led by exports. The Euro’s exchange rate is therefore of significant importance.

Too much EU debt and too many weak EU sisters will keep Greece in and Poland out. Only Krugman, Stiglitz or Piketty could spin that into a positive. One thing is for sure, Keynes wouldn’t think so.